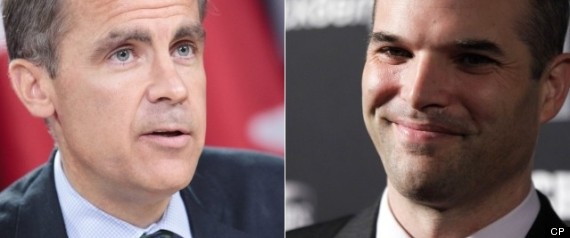

Matt Taibbi, the Rolling Stone finance writer who rose to fame with his description of Goldman Sachs as a “vampire squid,” set his sights on Mark Carney in a blog post Thursday.

Clearly, Taibbi is no fan of the current Bank of Canada governor and soon-to-be Bank of England governor.

Carney “is no Elliott Ness, brought in from the outside to clean the streets of Chicago,” Taibbi wrote. “Instead, he's another Geithner-esque character who will almost certainly prefer a hands-off regulatory approach....”

Taibbi added: “He'll likely be another central banker in the mold of Ben Bernanke, who's used endless rivers of cheap loans and money-printing programs like Quantitative Easing to keep floating corrupt banks all night long, for as long as they want to keep playing the roulette table.”

As backing for his argument, Taibbi points to an opinion piece in The Guardian that argues Carney’s Goldman Sachs pedigree means the U.K. will see only more of the same from its central bank with Carney at the helm.

Carney “favours an ‘open and resilient financial system’ – code for giving the banks free rein in global capital markets,” Ann Pettifor wrote. (Her column also appeared in The Huffington Post UK.)

“So be very afraid. Business-as-usual will prevail. And nothing will be done to constrain the City, and therefore to prevent the next collapse of the financial system.”

The argument that Carney is tainted by his Goldman Sachs background is not new, but it ignores the sometimes surprisingly populist attitudes Carney has expressed in his post-Goldman years, particularly as head of the Bank of Canada.

He caught more than a few people by surprise last year when he described the Occupy Wall Street movement as “entirely constructive.”

Said Carney on the CBC: "I understand the frustration of many people, particularly in the United States …You've had increase in inequality because of ... globalization, because of technology. You've had a big increase in the ratio of CEO earnings to workers on the shop floor."

And then, whether intentionally or not, he became something of a poster boy for banking reform when he got into a public battle with Jamie Dimon, the CEO of JPMorgan. Dimon reportedly launched into a long tirade against Carney at a meeting in New York in the fall of 2011 over a package of proposed reforms to the global banking system known as Basel III.

According to news reports, Carney stormed out of the meeting, and two days later he gave a speech in which he declared that "if some institutions feel pressure today, it is because they have done too little for too long, not because they are being asked to do too much, too soon."

History seemed to be on Carney’s side on that one. A few months later, the U.S. announced it would implement the Basel III rules, and a few months after that, Carney was appointed the head of the Financial Stability Board, a global group that, along with the Bank for International Settlements, oversees the implementation of the Basel III rules.

Whatever the truth on Carney's track record, Taibbi's column employs some truly amusing language to describe what he sees as the problem with Carney:

What the banking system really needs is a guy who will step in and force bankers to go back to being boring, risk-averse drips who lend businesses money to buy new equipment or fleets of trucks or whatever. What we have instead are coked-up wannabe big shots straight out of Boiler Room who are washing Mexican drug money and laundering Middle Eastern cash and playing around with wild price-fixing schemes – pretty much everything you can think of that isn't quietly counting beans and helping grow the economy.

Read the whole thing here.

Original Article

Source: huffington post

Author: Daniel Tencer

Clearly, Taibbi is no fan of the current Bank of Canada governor and soon-to-be Bank of England governor.

Carney “is no Elliott Ness, brought in from the outside to clean the streets of Chicago,” Taibbi wrote. “Instead, he's another Geithner-esque character who will almost certainly prefer a hands-off regulatory approach....”

Taibbi added: “He'll likely be another central banker in the mold of Ben Bernanke, who's used endless rivers of cheap loans and money-printing programs like Quantitative Easing to keep floating corrupt banks all night long, for as long as they want to keep playing the roulette table.”

As backing for his argument, Taibbi points to an opinion piece in The Guardian that argues Carney’s Goldman Sachs pedigree means the U.K. will see only more of the same from its central bank with Carney at the helm.

Carney “favours an ‘open and resilient financial system’ – code for giving the banks free rein in global capital markets,” Ann Pettifor wrote. (Her column also appeared in The Huffington Post UK.)

“So be very afraid. Business-as-usual will prevail. And nothing will be done to constrain the City, and therefore to prevent the next collapse of the financial system.”

The argument that Carney is tainted by his Goldman Sachs background is not new, but it ignores the sometimes surprisingly populist attitudes Carney has expressed in his post-Goldman years, particularly as head of the Bank of Canada.

He caught more than a few people by surprise last year when he described the Occupy Wall Street movement as “entirely constructive.”

Said Carney on the CBC: "I understand the frustration of many people, particularly in the United States …You've had increase in inequality because of ... globalization, because of technology. You've had a big increase in the ratio of CEO earnings to workers on the shop floor."

And then, whether intentionally or not, he became something of a poster boy for banking reform when he got into a public battle with Jamie Dimon, the CEO of JPMorgan. Dimon reportedly launched into a long tirade against Carney at a meeting in New York in the fall of 2011 over a package of proposed reforms to the global banking system known as Basel III.

According to news reports, Carney stormed out of the meeting, and two days later he gave a speech in which he declared that "if some institutions feel pressure today, it is because they have done too little for too long, not because they are being asked to do too much, too soon."

History seemed to be on Carney’s side on that one. A few months later, the U.S. announced it would implement the Basel III rules, and a few months after that, Carney was appointed the head of the Financial Stability Board, a global group that, along with the Bank for International Settlements, oversees the implementation of the Basel III rules.

Whatever the truth on Carney's track record, Taibbi's column employs some truly amusing language to describe what he sees as the problem with Carney:

What the banking system really needs is a guy who will step in and force bankers to go back to being boring, risk-averse drips who lend businesses money to buy new equipment or fleets of trucks or whatever. What we have instead are coked-up wannabe big shots straight out of Boiler Room who are washing Mexican drug money and laundering Middle Eastern cash and playing around with wild price-fixing schemes – pretty much everything you can think of that isn't quietly counting beans and helping grow the economy.

Read the whole thing here.

Original Article

Source: huffington post

Author: Daniel Tencer

No comments:

Post a Comment