In 1956 Texan geochemist Marion King Hubbert

made a presentation to the annual meeting of the American Petroleum

Institute in San Antonio, Texas. King Hubbert (as he was known to many)

made a bold prediction, that in every geographical area, from a single

oil field to the entire planet, the rate of petroleum production would

follow a logistic distribution (frequently, erroneously, referred to as a

"bell-shaped" curve). Extraction of oil would rise, gradually hit a

peak, and then irreversibly decline and tail off. On the face of it, it

seems like a common sense enough notion; oil, a fossil fuel, is after

all, a finite resource. Although the height of the curve and its

duration might vary depending on the size of the reserves, in the end

one cannot wring proverbial blood (or in this case, oil) out of a stone.

Oil production will hit a peak, and then logarithmically decline.

King Hubbert's theory was received by a storm of protest. In a world based on profligate consumption and the illusion of endless growth, the proposition that we might run out of oil to grease the wheels of commerce was not a popular one. King Hubbert, a Texas oilman himself, understood the implications of his theory from a conservationist perspective, writing:

"We are in a crisis in the evolution of human society. It's unique to both human and geologic history. It has never happened before and it can't possibly happen again. You can only use oil once. You can only use metals once. Soon all the oil is going to be burned and all the metals mined and scattered."

Based on the size of oil reserves, the technology of extraction and its efficiencies, rates of historical extraction, and market forces, King Hubbert and others made predictions on when global "peak oil" would arrive. The dates 1970, 1995, 2004, 2010, 2020, etc. were all proposed, and debate has continued in academic and commercial circles as to whether society has already attained -- or perhaps even passed -- peak oil. Author Matthew Simmons observes that "...peaking is one of these fuzzy events that you only know clearly when you see it through a rear view mirror, and by then an alternate resolution is generally too late."

Since fossil fuels, and in particular oil, are central to a plethora of human activities -- transportation, heating, the production of fertilizers, plastics, detergents, solvents, and adhesives -- and since these, in turn are key elements of global commerce, communications, agriculture, urban design, manufacturing, etc., the ripples of peak oil soon build on these shoals into social and economic tsunamis. To say that a global decline of oil would cause a drastic change in human civilization would probably be to understate the case. Hence the oil industry, economists, planners, technologists, and politicians -- amongst others -- have paid considerable attention to peak oil and its implications.

It has also been the focus of environmentalists, who, as George Monbiot points out in his essay We were wrong on peak oil. There's enough to fry us all have been of two minds about its implications. On the one hand the inevitability of the decline oil provides a powerful impetus to wean human civilization off this black milk. Governments, agriculture, industry, and consumers might conceivably be jolted out of complacency faced with this stark reality, and its social, economic, and political implications -- even if they cared not a fig about the environment itself. The flip side of the sword of peak oil hanging over our collective heads, is that rather than embracing conservation, renewable energy, permaculture, life-style changes, and a steady-state economy, it might instead prompt a panicked leap from the oily frying pan into the coal and biofuel fire, clutching desperately at even-more damaging resources and technologies in order to avoid the inevitable. Furthermore, in the globally interconnected economy of the 21st century, replete with hysterical market forces, speculative banking practices over-leveraged on various esoteric derivative financial products, and debt-laden national economies, who knows what further chaos peak oil might unleash?

From one vantage, King Hubbert was undoubtedly right. Oil is a finite resource and at some point it must inevitably peak, decline, and then run out. However, the Earth has been busy sequestering carbon since at least the early days of the Carboniferous Era about 360 million years ago, and it's had plenty of time to salt away a lot of hydrocarbons. Moreover, there are three key variables in Hubbert's model of peak oil -- the size of reserves, the technology of extraction, and market forces -- which inject such a degree of variability into the model as to render it effectively moot when it comes to projecting an actual date of peak oil. And one wildcard -- climate change -- that may render the exercise utterly pointless.

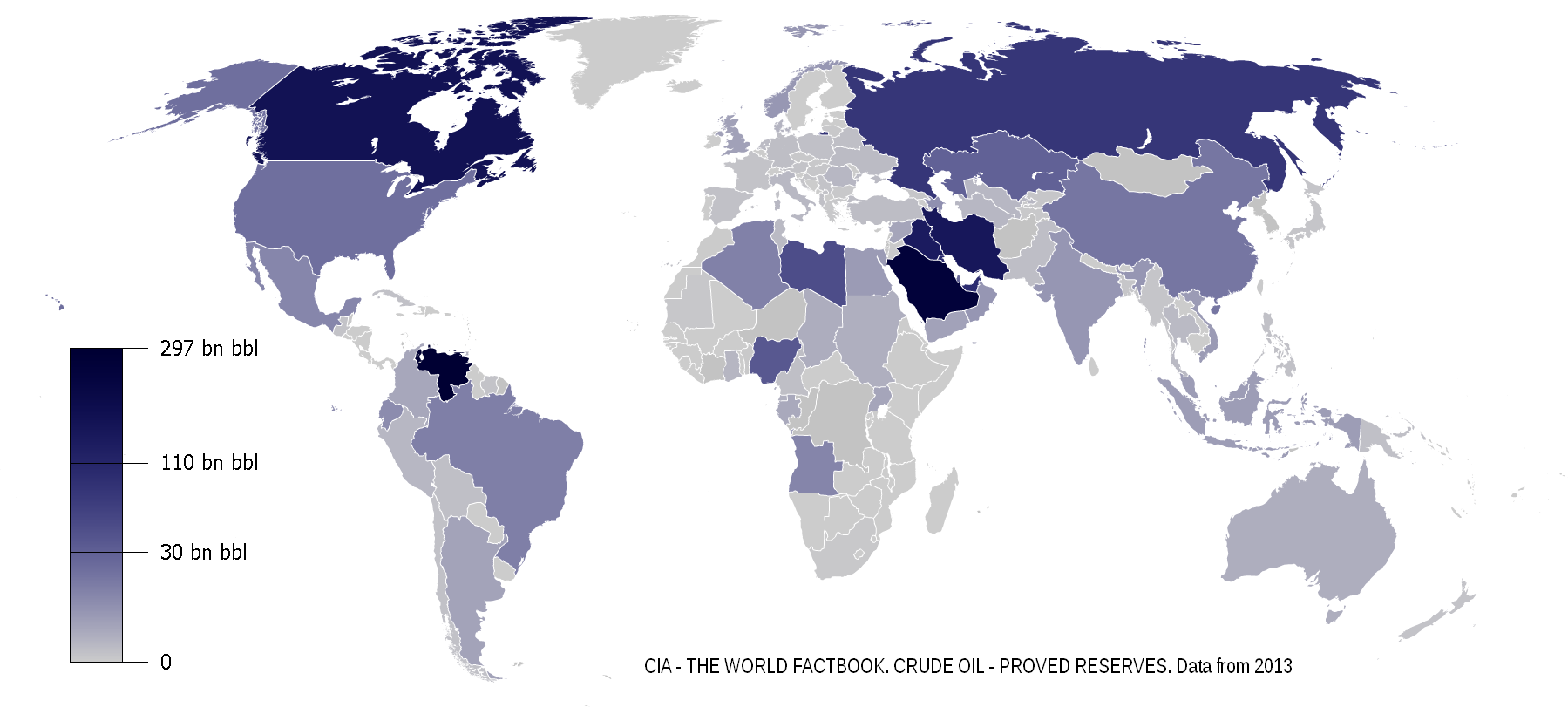

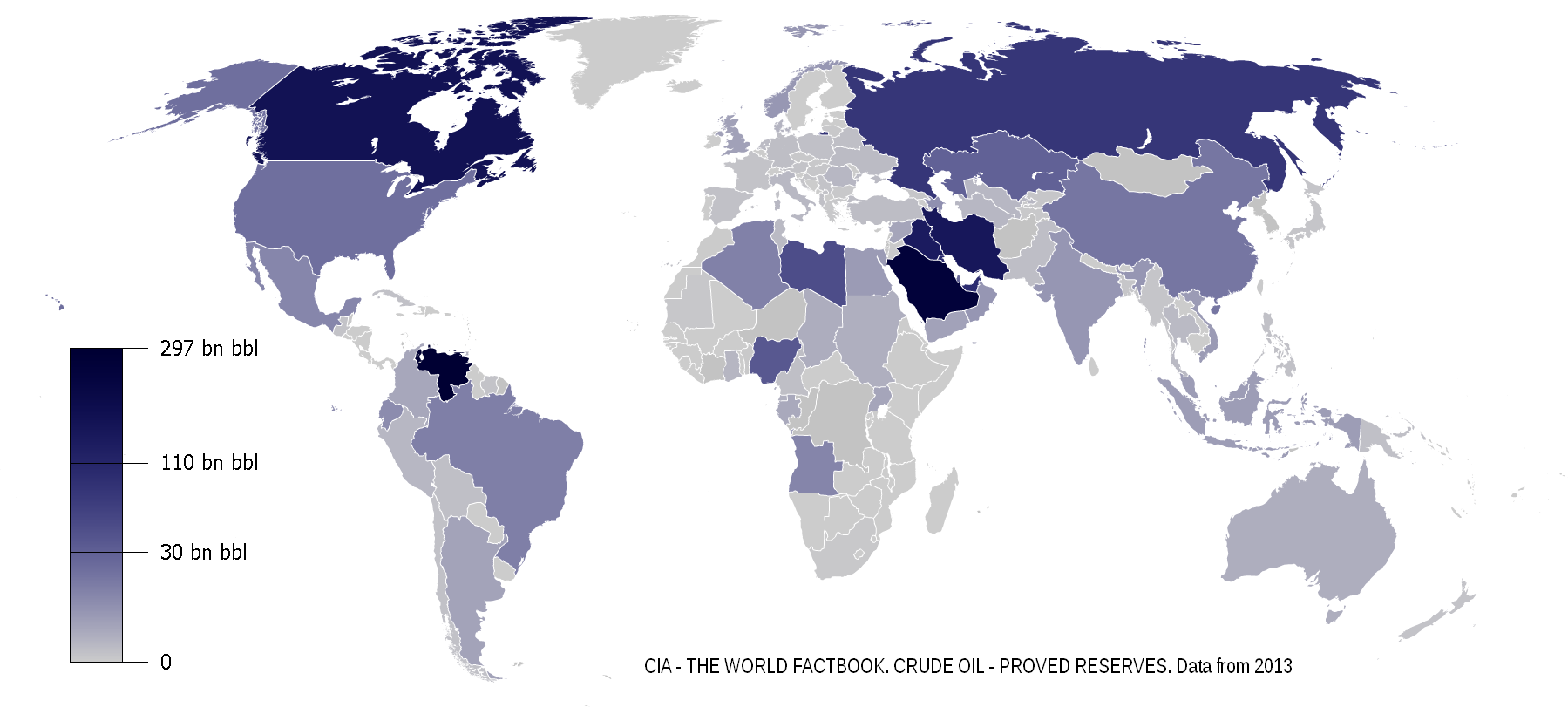

Oil Reserves

Oil reserves are categorized as proven, probable, and possible. 2P (proven + probable) estimates are often given in the range of 1,150-1,350 Gigabarrels of oil but due to misinformation and disinformation many analysts believe that this is overstated by some 25 per cent. As for "possible" reserves, almost any fictional value can be concocted. Additionally, as a result of historical convention, the quantities of oil found in bitumen sands and oil shales are not included in these reserve amounts, nor is oil that can potentially be created through natural gas to liquid processes or through coal to liquid technology.

Technology

Intimately connected to estimates of reserves is the technology of extraction. The days of simply sticking a pipe into the Texas outback or the Saudi desert and producing an oil gyser are fast disappearing. The technology of extracting oil has grown by leaps and bounds. Hitherto inaccessible deposits of oil deep beneath the continental shelves are now regularly being exploited from Louisiana to the North Sea.

Moreover, nowhere is technology more important than with respect to "unconventional" oil - the Athabaska bitumen sands, the extra heavy oil of the Orinoco Basin, the oil shale formations of the American West, and the Brazilian pre-salt oils. Earlier drilling, extraction, and refining technologies previously consigned such hydrocarbon deposits as impossible to utilize. Now technologies such as horizontal drilling and hydraulic fracturing (a.k.a., fracking) in the case of oil shales, and steam assisted gravity drainage (SAGD) in the case of bitumen sands, have made it possible to effectively tap these deposits.

Market Forces

In any economic equation of oil extraction, the price of the product is a central determinant of economic feasibility. From the end of the Second World War until 1973 oil prices consistently hovered between USD $20-25 per barrel. During the "energy crisis" of the 1970's it abruptly increased in value to $104 per barrel by 1980. Prices then gradually returned to those of the earlier era, hovering at the $20-30 range in the decade between 1993 and 2002.

However, crude oil prices have again increased, currently at $100 per barrel for the international standard Brent Crude and $87 for West Texas Intermediate (WTI). If a commodity quadruples in value, a huge spectrum of what was hitherto uneconomic becomes profitable.

The wildcard: Climate change

All of the above matters not a whit if our planet fries. Aside from the (not insignificant) moral, ethical, social, and environmental costs of out-of-control climate change, the economic costs of adaptation to, and remediation of, the effects of climate change would almost certainly be degrees of magnitude greater than any revenues derived from oil extraction itself. Human civilization may currently be between a rock and hard place, but the granite stone of climate change is far harder and more abrasive than the hard decisions required to transition away from profligate fossil fuel use.

Burn, Baby, Burn

An incendiary has just landed on this petro-landscape with the publication of Leonardo Maugeri's study Oil: The next revolution. The unprecedented upsurge of oil production capacity and what it means for the world published by the Belfer Center for Science and International Affairs of the Harvard Kennedy School. Maugeri, a world expert on oil, gas, and energy, has rewritten the narrative of peak oil. Examining current oil "plays" and those on the cusp of being developed, Maugeri forecasts a continuing rise in oil production from the current 93 million barrels a day (mbd) in 2011 to 110.6 mbd in 2020, an increase of 17.6 mbd (i.e., 19 per cent). This is actually a rather conservative estimate that considers both risk factors to development and the depletion rates of current oilfields. This expansion will be seen in all of the world's top 23 oil producers save for Norway, United Kingdom, Mexico, and Iran (and for the latter two this is due to political factors).

What's responsible for this dramatic increase? In part it is due to unparallel investment in the sector which has increased since 2003 and which amounted to USD $1.5 trillion over the last three years. However, the principal factor is the "de-conventionalization" of oil supply, notably the US shale/tight oils, the Canadian bitumen sands, Venezuela's heavy oils, and Brazil's pre-salt oils. For example, the hitherto undeveloped Bakken/Three Forks tight oil formation in North Dakota and Montana has the potential of producing as much oil as a large Persian Gulf country, all within the United States -- and the US has some 20 shale/tight oil formations, some of which may rival the Bakken field. By 2020 Maugeri forecasts that the US could supply 65 per cent of its own oil demand. Moreover, most shale/tight oil developments are profitable at oil prices (WTI) of $50 to $65 per barrel, thus offering a significant resilience to changing economic circumstances. Furthermore, except for the United States, shale/tight oil resources are still almost completely unexplored and unknown. Who knows what additional reserves might exist on the planet, ready to be fracked into production.

In Canada, the Athabaska bitumen sands represent a similar scenario. Production has increased from 600,000 barrels per day in 2000 to 1.5 mbd in 2011 and Maugeri forecasts that production could reach 6.8 mbd by 2020, more than quadrupling by the end of the decade. In contrast to the US tight/oil shales, the costs to extract oil from the bitumen sands are amongst the highest of all unconventional oil plays examined by Maugeri, only being profitable at rates of return greater than $90 per barrel.

What all this means is that there are still massive quantities of conventional and unconventional oil in the ground, and peak oil appears to be nowhere on the immediate horizon. Long before peak oil impels us to change to renewable energy and sustainable practices, we will have cooked our goose through climate change and other environmental impacts. Moreover, Maugeri points out that the current upswing in oil production will lead to major overproduction of oil, and a consequent decline in prices, unless oil demand grows at an annual rate of 1.6 per cent for the entire next decade, thereby pouring an ever increasing amount of carbon dioxide into the atmosphere.

The Environment

There is, however, the little problem of the environment .... Maugeri observes:

"The principal difficulty concerning shale gas is the effect of hydraulic fracturing on the environment, which is perceived as contributing to water and land contamination, natural gas infiltration into fresh water aquifers, poisoning of the subsoil because of the intensive use of chemicals, and even minor earthquakes."

And:

"Environmental concerns about massive tar sands exploitation may obstruct or delay future development .... There is strong environmental opposition to building new pipelines on U.S. territory to transport the corrosive and pollutant heavy oils from Canadian tar sands. Among other concerns, the tar sands' carbon footprint is 17 to 23 per cent larger than that of light oil. The same opposition that stopped the Keystone XL makes future prospects of Canadian oil exports to the U.S. less certain."

And:

"A revolution in environmental and emission-curbing technologies is required to sustain the development of most unconventional oils -- along with strong enforcement of existing rules. Without such a revolution, a continuous clash between the industry and environmental groups will force the governments to delay or constrain the development of new projects."

In a series of articles for rabble.ca (Head in the sand, tar in every orifice: Climate change policy in Canada; Thermometer rising: Ice, methane and climate change; Pestilence, famine and climate change: Horseman of the Apocalypse; and Acid bath: Evil twin of climate change) I have touched on some of the problems associated with climate change and so I won't belabor the points here. Suffice it to say that anthropogenic (i.e., human induced) climate change is speedily affecting the environment, the oceans, and the atmosphere in a way that is unsustainable, even over the course of the next few decades. We simply have to get off the burning carbon escalator. The consequences of not doing so are so grave as to hardly stomach contemplating.

What is crystal clear, however, is that neither technology, nor the marketplace will get us there. Although the low-hanging fruit of oil deposits have long since been picked, oil extraction technology has and will continue to improve and hence open up more reserves of conventional oil in hitherto inaccessible areas, such as in ever deeper oceanic waters and in remote regions like the arctic as sea ice continues to disappear; and unconventional oil deposits of all kinds located in all manner of places. And tomorrow's oil extraction technology will doubtless be even better.

Neither will we be saved by the marketplace. As Maugeri writes, "The age of cheap oil is probably behind us." It's unlikely that oil prices will ever again dip below $70 per barrel and the sky is the limit in terms of where they may climb. Most unconventional oil plays (save for the Athabaska tar sands) are economic at that price, and the more it rises the greater the incentive to profiteer.

The only avenue to avoid disaster is a political one. Setting aside the perpetual greed of the marketplace, and our endless techno-fascination, we must compel governments to put the needs of the citizens of planet earth, and the very earth itself, at the forefront. Government will, policy, and actions to reduce carbon emissions, transition to renewable energy technologies, and adopt sustainable development models, are indispensable if we are to survive. Moreover, transition measures take time to implement. The 2005 Hirsch Report (Peaking of World Oil Production: Impacts, Mitigation, and Risk Management, commonly referred to as the Hirsch Report after its lead author, Robert Hirsch) advocated developing alternatives to fossil fuels over a span of a couple of decades while transitioning away from non-renewables.

It must be said that, given the recent failure of the Rio +20 United Nations Conference on Sustainable Development to achieve any meaningful progress in this regard, this might not be a particularly optimistic note to end on. Nonetheless, it is critical that we redouble our political efforts, if not initially on a multilateral level, then at the level of nation states, provinces, cities, and individual communities. Petroleum has become the sorcerer's apprentice of contemporary civilization. It performs all manner of useful tasks but it, and its noxious effluents, threaten to destroy the very civilization they serve. We must break the spell -- now.

A postscript of greed

With what strikes me as some degree of bewilderment, Magueri reports, "At more than $100 per barrel, the international benchmark crude Brent is $20 to $25 above the marginal cost of oil production." In the hyper-free market world we inhabit, what can possibly explain this enormous (circa 25 per cent) disparity in what is arguably the most important commodity in the world? Struggling for an answer Magueri attempts to answer his own question: "Only geopolitical and psychological factors (above all, a major crisis related to Iran) and a still deep-rooted belief that oil is about to become a scarce commodity, can explain the departure of oil prices from economic fundamentals."

Without descending into the wormhole of conspiracy theory, one might nonetheless with justification ask whose interests the promulgation of endless crises in the Middle East serves? How much extra money is being made daily as a result of the $20-25 differential between the marginal cost of oil and the current $100 per barrel price of Brent Crude? Considering that world oil production is now 93 mbd and multiplying by $20 per barrel (using the low end of the estimates) equals $1.86 billion in extra profits a day, and thus $680 billion in extra profits per year. Is this a tidy enough sum that it might incline petro-interests (national or corporate) to engage in some geo-political manipulation? I leave it to you, dear reader, to deliver a judgment.

Original Article

Source: rabble.ca

Author: Christopher Majka

King Hubbert's theory was received by a storm of protest. In a world based on profligate consumption and the illusion of endless growth, the proposition that we might run out of oil to grease the wheels of commerce was not a popular one. King Hubbert, a Texas oilman himself, understood the implications of his theory from a conservationist perspective, writing:

"We are in a crisis in the evolution of human society. It's unique to both human and geologic history. It has never happened before and it can't possibly happen again. You can only use oil once. You can only use metals once. Soon all the oil is going to be burned and all the metals mined and scattered."

Based on the size of oil reserves, the technology of extraction and its efficiencies, rates of historical extraction, and market forces, King Hubbert and others made predictions on when global "peak oil" would arrive. The dates 1970, 1995, 2004, 2010, 2020, etc. were all proposed, and debate has continued in academic and commercial circles as to whether society has already attained -- or perhaps even passed -- peak oil. Author Matthew Simmons observes that "...peaking is one of these fuzzy events that you only know clearly when you see it through a rear view mirror, and by then an alternate resolution is generally too late."

Since fossil fuels, and in particular oil, are central to a plethora of human activities -- transportation, heating, the production of fertilizers, plastics, detergents, solvents, and adhesives -- and since these, in turn are key elements of global commerce, communications, agriculture, urban design, manufacturing, etc., the ripples of peak oil soon build on these shoals into social and economic tsunamis. To say that a global decline of oil would cause a drastic change in human civilization would probably be to understate the case. Hence the oil industry, economists, planners, technologists, and politicians -- amongst others -- have paid considerable attention to peak oil and its implications.

It has also been the focus of environmentalists, who, as George Monbiot points out in his essay We were wrong on peak oil. There's enough to fry us all have been of two minds about its implications. On the one hand the inevitability of the decline oil provides a powerful impetus to wean human civilization off this black milk. Governments, agriculture, industry, and consumers might conceivably be jolted out of complacency faced with this stark reality, and its social, economic, and political implications -- even if they cared not a fig about the environment itself. The flip side of the sword of peak oil hanging over our collective heads, is that rather than embracing conservation, renewable energy, permaculture, life-style changes, and a steady-state economy, it might instead prompt a panicked leap from the oily frying pan into the coal and biofuel fire, clutching desperately at even-more damaging resources and technologies in order to avoid the inevitable. Furthermore, in the globally interconnected economy of the 21st century, replete with hysterical market forces, speculative banking practices over-leveraged on various esoteric derivative financial products, and debt-laden national economies, who knows what further chaos peak oil might unleash?

From one vantage, King Hubbert was undoubtedly right. Oil is a finite resource and at some point it must inevitably peak, decline, and then run out. However, the Earth has been busy sequestering carbon since at least the early days of the Carboniferous Era about 360 million years ago, and it's had plenty of time to salt away a lot of hydrocarbons. Moreover, there are three key variables in Hubbert's model of peak oil -- the size of reserves, the technology of extraction, and market forces -- which inject such a degree of variability into the model as to render it effectively moot when it comes to projecting an actual date of peak oil. And one wildcard -- climate change -- that may render the exercise utterly pointless.

Oil Reserves

Oil reserves are categorized as proven, probable, and possible. 2P (proven + probable) estimates are often given in the range of 1,150-1,350 Gigabarrels of oil but due to misinformation and disinformation many analysts believe that this is overstated by some 25 per cent. As for "possible" reserves, almost any fictional value can be concocted. Additionally, as a result of historical convention, the quantities of oil found in bitumen sands and oil shales are not included in these reserve amounts, nor is oil that can potentially be created through natural gas to liquid processes or through coal to liquid technology.

Technology

Intimately connected to estimates of reserves is the technology of extraction. The days of simply sticking a pipe into the Texas outback or the Saudi desert and producing an oil gyser are fast disappearing. The technology of extracting oil has grown by leaps and bounds. Hitherto inaccessible deposits of oil deep beneath the continental shelves are now regularly being exploited from Louisiana to the North Sea.

Moreover, nowhere is technology more important than with respect to "unconventional" oil - the Athabaska bitumen sands, the extra heavy oil of the Orinoco Basin, the oil shale formations of the American West, and the Brazilian pre-salt oils. Earlier drilling, extraction, and refining technologies previously consigned such hydrocarbon deposits as impossible to utilize. Now technologies such as horizontal drilling and hydraulic fracturing (a.k.a., fracking) in the case of oil shales, and steam assisted gravity drainage (SAGD) in the case of bitumen sands, have made it possible to effectively tap these deposits.

Market Forces

In any economic equation of oil extraction, the price of the product is a central determinant of economic feasibility. From the end of the Second World War until 1973 oil prices consistently hovered between USD $20-25 per barrel. During the "energy crisis" of the 1970's it abruptly increased in value to $104 per barrel by 1980. Prices then gradually returned to those of the earlier era, hovering at the $20-30 range in the decade between 1993 and 2002.

However, crude oil prices have again increased, currently at $100 per barrel for the international standard Brent Crude and $87 for West Texas Intermediate (WTI). If a commodity quadruples in value, a huge spectrum of what was hitherto uneconomic becomes profitable.

The wildcard: Climate change

All of the above matters not a whit if our planet fries. Aside from the (not insignificant) moral, ethical, social, and environmental costs of out-of-control climate change, the economic costs of adaptation to, and remediation of, the effects of climate change would almost certainly be degrees of magnitude greater than any revenues derived from oil extraction itself. Human civilization may currently be between a rock and hard place, but the granite stone of climate change is far harder and more abrasive than the hard decisions required to transition away from profligate fossil fuel use.

Burn, Baby, Burn

An incendiary has just landed on this petro-landscape with the publication of Leonardo Maugeri's study Oil: The next revolution. The unprecedented upsurge of oil production capacity and what it means for the world published by the Belfer Center for Science and International Affairs of the Harvard Kennedy School. Maugeri, a world expert on oil, gas, and energy, has rewritten the narrative of peak oil. Examining current oil "plays" and those on the cusp of being developed, Maugeri forecasts a continuing rise in oil production from the current 93 million barrels a day (mbd) in 2011 to 110.6 mbd in 2020, an increase of 17.6 mbd (i.e., 19 per cent). This is actually a rather conservative estimate that considers both risk factors to development and the depletion rates of current oilfields. This expansion will be seen in all of the world's top 23 oil producers save for Norway, United Kingdom, Mexico, and Iran (and for the latter two this is due to political factors).

What's responsible for this dramatic increase? In part it is due to unparallel investment in the sector which has increased since 2003 and which amounted to USD $1.5 trillion over the last three years. However, the principal factor is the "de-conventionalization" of oil supply, notably the US shale/tight oils, the Canadian bitumen sands, Venezuela's heavy oils, and Brazil's pre-salt oils. For example, the hitherto undeveloped Bakken/Three Forks tight oil formation in North Dakota and Montana has the potential of producing as much oil as a large Persian Gulf country, all within the United States -- and the US has some 20 shale/tight oil formations, some of which may rival the Bakken field. By 2020 Maugeri forecasts that the US could supply 65 per cent of its own oil demand. Moreover, most shale/tight oil developments are profitable at oil prices (WTI) of $50 to $65 per barrel, thus offering a significant resilience to changing economic circumstances. Furthermore, except for the United States, shale/tight oil resources are still almost completely unexplored and unknown. Who knows what additional reserves might exist on the planet, ready to be fracked into production.

In Canada, the Athabaska bitumen sands represent a similar scenario. Production has increased from 600,000 barrels per day in 2000 to 1.5 mbd in 2011 and Maugeri forecasts that production could reach 6.8 mbd by 2020, more than quadrupling by the end of the decade. In contrast to the US tight/oil shales, the costs to extract oil from the bitumen sands are amongst the highest of all unconventional oil plays examined by Maugeri, only being profitable at rates of return greater than $90 per barrel.

What all this means is that there are still massive quantities of conventional and unconventional oil in the ground, and peak oil appears to be nowhere on the immediate horizon. Long before peak oil impels us to change to renewable energy and sustainable practices, we will have cooked our goose through climate change and other environmental impacts. Moreover, Maugeri points out that the current upswing in oil production will lead to major overproduction of oil, and a consequent decline in prices, unless oil demand grows at an annual rate of 1.6 per cent for the entire next decade, thereby pouring an ever increasing amount of carbon dioxide into the atmosphere.

The Environment

There is, however, the little problem of the environment .... Maugeri observes:

"The principal difficulty concerning shale gas is the effect of hydraulic fracturing on the environment, which is perceived as contributing to water and land contamination, natural gas infiltration into fresh water aquifers, poisoning of the subsoil because of the intensive use of chemicals, and even minor earthquakes."

And:

"Environmental concerns about massive tar sands exploitation may obstruct or delay future development .... There is strong environmental opposition to building new pipelines on U.S. territory to transport the corrosive and pollutant heavy oils from Canadian tar sands. Among other concerns, the tar sands' carbon footprint is 17 to 23 per cent larger than that of light oil. The same opposition that stopped the Keystone XL makes future prospects of Canadian oil exports to the U.S. less certain."

And:

"A revolution in environmental and emission-curbing technologies is required to sustain the development of most unconventional oils -- along with strong enforcement of existing rules. Without such a revolution, a continuous clash between the industry and environmental groups will force the governments to delay or constrain the development of new projects."

In a series of articles for rabble.ca (Head in the sand, tar in every orifice: Climate change policy in Canada; Thermometer rising: Ice, methane and climate change; Pestilence, famine and climate change: Horseman of the Apocalypse; and Acid bath: Evil twin of climate change) I have touched on some of the problems associated with climate change and so I won't belabor the points here. Suffice it to say that anthropogenic (i.e., human induced) climate change is speedily affecting the environment, the oceans, and the atmosphere in a way that is unsustainable, even over the course of the next few decades. We simply have to get off the burning carbon escalator. The consequences of not doing so are so grave as to hardly stomach contemplating.

What is crystal clear, however, is that neither technology, nor the marketplace will get us there. Although the low-hanging fruit of oil deposits have long since been picked, oil extraction technology has and will continue to improve and hence open up more reserves of conventional oil in hitherto inaccessible areas, such as in ever deeper oceanic waters and in remote regions like the arctic as sea ice continues to disappear; and unconventional oil deposits of all kinds located in all manner of places. And tomorrow's oil extraction technology will doubtless be even better.

Neither will we be saved by the marketplace. As Maugeri writes, "The age of cheap oil is probably behind us." It's unlikely that oil prices will ever again dip below $70 per barrel and the sky is the limit in terms of where they may climb. Most unconventional oil plays (save for the Athabaska tar sands) are economic at that price, and the more it rises the greater the incentive to profiteer.

The only avenue to avoid disaster is a political one. Setting aside the perpetual greed of the marketplace, and our endless techno-fascination, we must compel governments to put the needs of the citizens of planet earth, and the very earth itself, at the forefront. Government will, policy, and actions to reduce carbon emissions, transition to renewable energy technologies, and adopt sustainable development models, are indispensable if we are to survive. Moreover, transition measures take time to implement. The 2005 Hirsch Report (Peaking of World Oil Production: Impacts, Mitigation, and Risk Management, commonly referred to as the Hirsch Report after its lead author, Robert Hirsch) advocated developing alternatives to fossil fuels over a span of a couple of decades while transitioning away from non-renewables.

It must be said that, given the recent failure of the Rio +20 United Nations Conference on Sustainable Development to achieve any meaningful progress in this regard, this might not be a particularly optimistic note to end on. Nonetheless, it is critical that we redouble our political efforts, if not initially on a multilateral level, then at the level of nation states, provinces, cities, and individual communities. Petroleum has become the sorcerer's apprentice of contemporary civilization. It performs all manner of useful tasks but it, and its noxious effluents, threaten to destroy the very civilization they serve. We must break the spell -- now.

A postscript of greed

With what strikes me as some degree of bewilderment, Magueri reports, "At more than $100 per barrel, the international benchmark crude Brent is $20 to $25 above the marginal cost of oil production." In the hyper-free market world we inhabit, what can possibly explain this enormous (circa 25 per cent) disparity in what is arguably the most important commodity in the world? Struggling for an answer Magueri attempts to answer his own question: "Only geopolitical and psychological factors (above all, a major crisis related to Iran) and a still deep-rooted belief that oil is about to become a scarce commodity, can explain the departure of oil prices from economic fundamentals."

Without descending into the wormhole of conspiracy theory, one might nonetheless with justification ask whose interests the promulgation of endless crises in the Middle East serves? How much extra money is being made daily as a result of the $20-25 differential between the marginal cost of oil and the current $100 per barrel price of Brent Crude? Considering that world oil production is now 93 mbd and multiplying by $20 per barrel (using the low end of the estimates) equals $1.86 billion in extra profits a day, and thus $680 billion in extra profits per year. Is this a tidy enough sum that it might incline petro-interests (national or corporate) to engage in some geo-political manipulation? I leave it to you, dear reader, to deliver a judgment.

Original Article

Source: rabble.ca

Author: Christopher Majka

No comments:

Post a Comment